5 Key Retirement Planning Mistakes to Avoid in 2025

Planning for retirement requires careful consideration, and avoiding key mistakes such as underestimating expenses, delaying saving, and not diversifying investments is crucial for a secure financial future in 2025.

Planning for retirement can feel like navigating a complex maze, especially with ever-changing economic landscapes. However, by being aware of common pitfalls, you can significantly increase your chances of a comfortable and secure future. Let’s explore 5 key retirement planning mistakes to avoid in 2025, equipping you with the knowledge to make informed decisions.

Failing to Start Saving Early Enough

One of the most significant mistakes people make is procrastinating on saving for retirement. The power of compounding interest is a key factor in building a substantial retirement nest egg, and time is its greatest ally. Starting early, even with small contributions, can make a huge difference over the long term.

The Power of Compounding

Compounding is the process of earning returns on your initial investment, as well as on the accumulated interest or gains. The earlier you start, the more time your money has to grow exponentially.

Catching Up Later

While it’s always better to start late than never, catching up later in life requires significantly higher contributions to achieve the same retirement goals. This can put a strain on your current finances and limit your financial flexibility.

- Start saving as early as possible to maximize the benefits of compounding.

- Contribute consistently, even if it’s a small amount.

- Increase your contributions gradually as your income grows.

Delaying saving for retirement not only reduces the potential for compounding but also necessitates more aggressive investment strategies later on, which may carry higher risks. Starting early provides peace of mind and a more secure financial future.

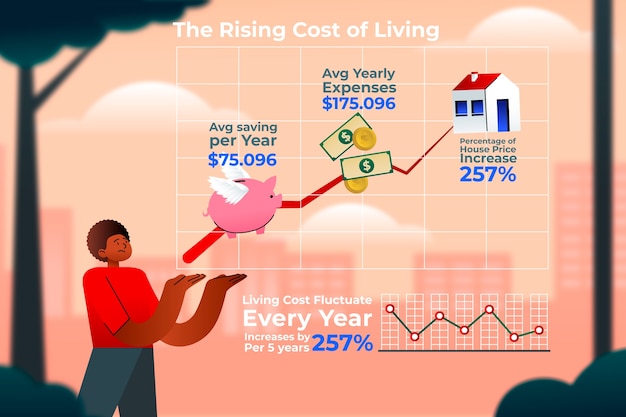

Underestimating Your Retirement Expenses

Many people underestimate how much money they will actually need in retirement. It’s crucial to have a clear understanding of your potential expenses to avoid running out of funds. Consider all aspects of your lifestyle, healthcare costs, and potential inflation.

Healthcare Costs

Healthcare expenses tend to increase significantly as people age. Factoring in potential medical bills, insurance premiums, and long-term care needs is essential for accurate retirement planning.

Lifestyle and Inflation

Your lifestyle during retirement will greatly influence your expenses. Account for hobbies, travel, dining out, and other leisure activities. Also, remember to consider inflation, which erodes the purchasing power of your savings over time.

- Create a detailed budget that reflects your desired retirement lifestyle.

- Factor in potential healthcare costs and long-term care needs.

- Account for inflation and its impact on your future expenses.

Underestimating your retirement expenses can lead to significant financial stress in the future. By carefully assessing your needs and planning accordingly, you can ensure a comfortable and worry-free retirement.

Not Diversifying Your Investments

Putting all your eggs in one basket is a risky strategy when it comes to retirement planning. Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, can help mitigate risk and improve long-term returns.

The Importance of Asset Allocation

Asset allocation is the process of dividing your investment portfolio among different asset classes. A well-diversified portfolio can help protect your savings from market volatility and ensure a more stable growth trajectory.

Understanding Risk Tolerance

Your risk tolerance plays a crucial role in determining your asset allocation strategy. Younger investors with a longer time horizon may be able to tolerate more risk, while those closer to retirement may prefer a more conservative approach.

- Diversify your investments across different asset classes to mitigate risk.

- Regularly review and rebalance your portfolio to maintain your desired asset allocation.

- Consider your risk tolerance and time horizon when making investment decisions.

Lack of diversification can expose your retirement savings to unnecessary risk. By diversifying your investments, you can create a more resilient portfolio that is better positioned to weather market fluctuations and achieve your long-term financial goals.

Ignoring the Impact of Taxes

Taxes can significantly impact your retirement savings and income. Understanding the tax implications of your retirement accounts and investments is crucial for effective planning. Failing to consider taxes can lead to unpleasant surprises and reduce your overall retirement income.

Tax-Advantaged Accounts

Utilizing tax-advantaged retirement accounts, such as 401(k)s and IRAs, can provide significant tax benefits. These accounts offer either tax-deferred growth or tax-free withdrawals, depending on the type of account.

Withdrawal Strategies

Creating a tax-efficient withdrawal strategy is essential for maximizing your retirement income. Consider the tax implications of different withdrawal options and plan accordingly to minimize your tax burden.

Ignoring the impact of taxes can significantly reduce your retirement income. By taking advantage of tax-advantaged accounts and developing a tax-efficient withdrawal strategy, you can keep more of your hard-earned savings.

Not Having a Clear Retirement Plan

Retirement planning is not a one-time event; it’s an ongoing process that requires regular review and adjustments. Failing to have a clear retirement plan and periodically assess your progress can lead to significant shortfalls.

Setting Goals and Tracking Progress

Defining your retirement goals, such as when you want to retire and what kind of lifestyle you want to lead, is essential for creating a comprehensive retirement plan. Regularly track your progress and make adjustments as needed to stay on track.

Seeking Professional Advice

Consider seeking guidance from a qualified financial advisor who can help you create a personalized retirement plan and provide ongoing support. A financial advisor can offer valuable insights and help you navigate the complexities of retirement planning.

- Create a comprehensive retirement plan that outlines your goals and strategies.

- Regularly review and update your plan to reflect changes in your circumstances.

- Consider seeking professional advice from a qualified financial advisor.

A well-defined retirement plan provides a roadmap for achieving your financial goals. By regularly reviewing and adjusting your plan, you can ensure that you stay on track and achieve a secure and fulfilling retirement.

| Key Point | Brief Description |

|---|---|

| ⏳ Start Saving Early | Begin saving as early as possible to harness the power of compounding interest. |

| 💰 Estimate Expenses | Accurately estimate your retirement expenses, including healthcare and lifestyle costs. |

| 📊 Diversify Investments | Spread your investments across different asset classes to mitigate risk. |

| 📝 Plan and Review | Create a detailed retirement plan and review it regularly to ensure you stay on track. |

Frequently Asked Questions

▼

The amount you should save depends on your lifestyle, expenses, and retirement goals. A common guideline is to aim for at least 80% of your pre-retirement income.

▼

Consider tax-advantaged accounts like 401(k)s and IRAs. Roth accounts offer tax-free withdrawals in retirement, while traditional accounts provide tax-deferred growth.

▼

Review your plan at least once a year, or more frequently if there are significant changes in your financial situation or life circumstances.

▼

Asset allocation involves dividing your investments among different asset classes like stocks, bonds, and real estate. It’s important to manage risk and optimize returns.

▼

You can start as early as age 62, but waiting until your full retirement age (usually 66-67) or age 70 can significantly increase your benefits.

Conclusion

Avoiding these 5 key retirement planning mistakes in 2025 can make a significant difference in your financial security and overall quality of life during retirement. By starting early, estimating expenses accurately, diversifying investments, considering taxes, and having a clear plan, you can pave the way for a comfortable and fulfilling retirement.