The Importance of a Financial Advisor: Finding the Right Fit in 2025

Finding the right financial advisor in 2025 is crucial for navigating the evolving financial landscape, ensuring personalized strategies for investment, retirement planning, and overall financial well-being, tailored to your unique goals and circumstances.

Navigating the complexities of personal finance can feel like traversing a maze. As we approach 2025, the need for expert guidance becomes even more apparent. The Importance of a Financial Advisor: Finding the Right Fit for 2025 lies in securing your financial future amidst an ever-changing economic climate.

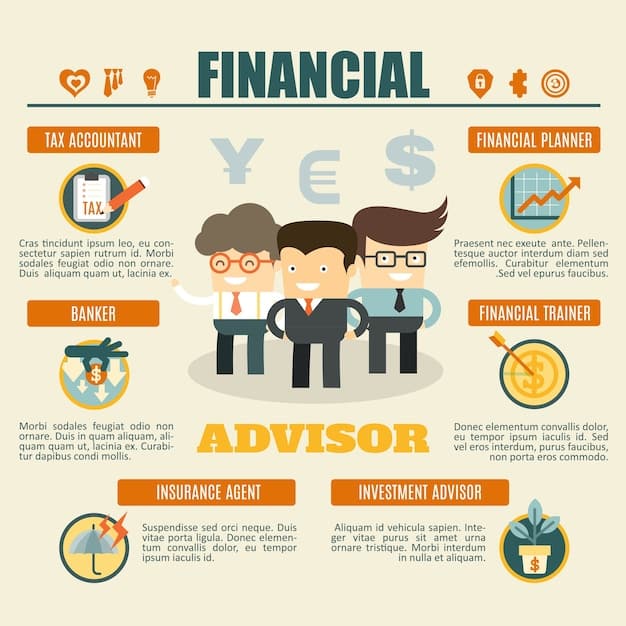

Understanding the Role of a Financial Advisor

Financial advisors play a pivotal role in helping individuals and families achieve their financial goals. They offer expert guidance and personalized strategies tailored to individual needs.

What Does a Financial Advisor Do?

A financial advisor’s responsibilities extend beyond simple investment advice. They provide comprehensive financial planning.

- Investment Management: Managing investment portfolios to achieve optimal returns based on risk tolerance.

- Retirement Planning: Developing strategies to ensure a comfortable and secure retirement.

- Estate Planning: Assisting with wealth transfer and legacy planning.

- Tax Optimization: Identifying tax-efficient strategies to minimize liabilities.

These services combined offer a holistic approach to managing finances effectively.

Financial advisors are instrumental in helping individuals make informed decisions about their money, aligning their actions with their long-term objectives.

The Evolving Financial Landscape: Why 2025 Matters

The financial landscape is constantly evolving, presenting both opportunities and challenges for investors and savers.

Key Trends to Watch in 2025

Several key trends are expected to shape the financial landscape in 2025.

Navigating these trends requires expertise and a proactive approach to financial planning. A financial advisor can help you understand these shifts and adapt your strategies accordingly.

- Technological Advancements: FinTech is reshaping how we manage money, from robo-advisors to mobile banking.

- Interest Rate Volatility: Fluctuations in interest rates can impact investments, requiring careful portfolio management.

- Inflation Concerns: Rising inflation erodes purchasing power, necessitating strategies to protect wealth.

Ignoring these trends could lead to missed opportunities or costly mistakes, emphasizing the value of professional guidance. Financial institutions continue development in this field.

Benefits of Hiring a Financial Advisor

Engaging a financial advisor offers numerous benefits. These professionals can provide expert insights and tailored advice that help individuals achieve their financial aspirations.

Personalized Financial Planning

One of the main advantages of working with a financial advisor is the creation of a personalized financial plan.

- Goal Setting: Defining short-term and long-term financial objectives.

- Risk Assessment: Evaluating risk tolerance to align investments with comfort levels.

- Customized Strategies: Developing tailored strategies to achieve specific financial goals.

Personalization ensures that financial plans are relevant and effective for each individual’s unique circumstances.

They bring objectivity and experience to the table, helping clients avoid common pitfalls and stay on track towards their goals.

Types of Financial Advisors: Finding the Right Fit

Financial advisors come in various forms, each with their own set of specialties and focuses.

Different Advisor Models

Understanding the different types of financial advisors available is crucial for making an informed choice.

- Fee-Only Advisors: Charge fees based on assets under management or hourly rates.

- Commission-Based Advisors: Earn commissions from selling financial products.

- Hybrid Advisors: Combine fee-based and commission-based compensation models.

- Robo-AdvisorsAutomated platforms that provide algorithm-driven investment advice at a lower cost.

Choosing the right type of advisor depends on personal preferences and financial needs. Some individuals prefer the transparency of fee-only advisors, while others may opt for commission-based advisors for specific product recommendations.

Evaluate the compensation models before making a decision to ensure transparency and alignment with your financial goals.

Key Considerations When Choosing a Financial Advisor

Selecting a financial advisor requires careful consideration of various factors to ensure compatibility and trust.

Factors to Consider

Take your time to research prospective advisors to ensure they are the right fit for your needs.

Before making your decision, discuss your financial goals and assess their approach to financial planning and investment management.

- Credentials and Experience: Look for advisors with relevant certifications such as CFP or CFA.

- Client Testimonials: Read reviews and testimonials to gauge client satisfaction.

- Fee Structure: Understand how the advisor is compensated to avoid conflicts of interest.

By evaluating these factors, you can make a well-informed decision and establish a beneficial relationship with your advisor. Verify credibility.

Preparing for Your First Meeting with a Financial Advisor

Proper preparation is essential for making the most of your first meeting with a financial advisor.

What to Bring and Expect

Prepare a summary of your financial situation, including income, expenses, assets, and liabilities. Be prepared to discuss your financial goals, risk tolerance, and any specific concerns you may have.

During the meeting, expect the advisor to ask questions about your financial history, goals, and values. They will also explain their services, fee structure, and investment approach.

- Financial Statements: Bring copies of bank statements, investment account statements, and tax returns.

- Goal List: Create a list of your short-term and long-term financial goals.

- Questions: Prepare a list of questions to ask the advisor, such as their investment philosophy and client service approach.

Use the meeting as an opportunity to assess the advisor’s communication style, expertise, and compatibility with your financial needs.

| Key Point | Brief Description |

|---|---|

| 📊 Personalized Planning | Tailored strategies to meet your unique financial goals. |

| 📈 Investment Management | Expert management of your investment portfolio. |

| 🛡️ Risk Assessment | Understanding and managing your risk tolerance. |

| 🎯 Goal Setting | Defining and planning for your financial objectives. |

Frequently Asked Questions

▼

Financial advisors provide personalized financial planning, expert investment management, and help navigate complex financial decisions, ensuring you stay on track towards your financial goals, while giving you oversight to manage risk successfully.

▼

Look for advisors with relevant credentials, positive client testimonials, and a transparent fee structure. Ensure their expertise aligns with your financial goals and that you feel comfortable communicating with them, too.

▼

Gather your financial statements, including income, expenses, assets, and liabilities. Prepare a list of your financial goals and any specific questions you have for the advisor. It saves time and you both get acquainted quickly.

▼

Key trends include technological advancements like FinTech, interest rate volatility, and inflation concerns. Financial advisors are adapting by offering more digital services and focusing on strategies to mitigate these risks to ensure you always are protected.

▼

A financial advisor can assess your retirement needs, develop a savings and investment strategy, and help you make informed decisions about retirement accounts and insurance options to help you have confidence in your nestegg when it counts.

Conclusion

In conclusion, the importance of a financial advisor in 2025 cannot be overstated. As the financial landscape becomes increasingly complex, these professionals offer the expertise and guidance needed to navigate challenges and achieve long-term financial success, helping you make confident choices for yourself and your family.