Family Financial Planning: Secure Your Future Together

Financial planning for families involves strategically managing finances, setting goals, and making informed decisions to achieve long-term security and prosperity together.

Embarking on financial planning for families: managing money and building a secure future together can appear daunting, but it’s a crucial step towards ensuring long-term stability and achieving shared aspirations. This guide provides a streamlined approach to navigate the complexities of family finances and build a resilient future, one strategic decision at a time.

Understanding the Basics of Family Financial Planning

Financial planning for families starts with understanding the fundamentals. This involves assessing the current financial situation, identifying goals, and recognizing the unique challenges families face when managing money together. It’s about creating a roadmap that aligns with the family’s values and aspirations.

Assessing Your Current Financial Situation

Before creating a financial plan, it is essential to evaluate your current financial standing. This provides a clear picture of where you are and what resources are available. Start by compiling a detailed overview of all income sources, including salaries, investments, and any other earnings.

Identifying Financial Goals

Identifying clear and specific financial goals is a crucial step in family financial planning. These goals can influence the strategies and decisions you will make.

- Short-term goals: These are objectives you aim to achieve within one to three years, such as paying off credit card debt or saving for a down payment on a car.

- Mid-term goals: These goals typically span three to ten years, like saving for a child’s education or buying a new home.

- Long-term goals: These are objectives you want to achieve in ten years or more, such as retirement planning or establishing a legacy for future generations.

Understanding the basics of family financial planning is the foundation for creating a secure financial future. By assessing the current situation and setting clear goals, families can begin to make informed decisions to achieve long-term financial security.

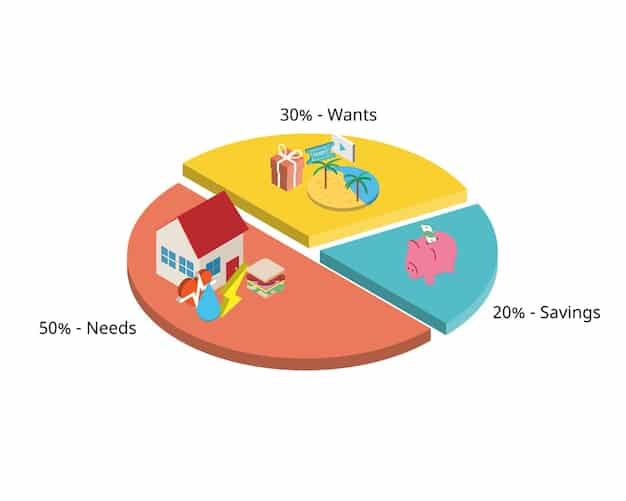

Creating a Family Budget: A Practical Approach

Creating a family budget is a practical and essential tool for managing finances effectively. It provides a clear overview of income, expenses, and savings, allowing families to make informed decisions and achieve their financial goals. A well-structured budget helps track spending, identify areas where cuts can be made, and ensure that funds are allocated according to the family’s priorities.

Tracking Income and Expenses

Tracking income and expenses is the first step in creating a family budget, offering insight into where your money comes from and where it goes.

Using Budgeting Tools and Apps

Leveraging budgeting tools and apps simplifies the process of tracking and managing your family’s finances. These tools provide automated tracking, categorization of expenses, and visual representations of your financial data.

Creating a family budget is a dynamic process that requires ongoing monitoring and adjustments. By tracking income and expenses and using budgeting tools, families can gain better control over their finances and work towards achieving their financial goals.

Saving and Investing for the Future

Saving and investing are essential for building a secure financial future for families. These strategies allow you to grow your wealth over time, providing financial security for both planned and unexpected expenses. Understanding the array of saving and investment options and making informed decisions are crucial steps in this process.

Exploring Different Savings Options

Exploring different savings options is important for families looking to build a financial safety net and achieve their short and long-term financial goals. Savings accounts, certificates of deposit (CDs), and money market accounts offer unique benefits and cater to different saving needs.

Introduction to Investing

Investing is the process of allocating money or capital with the expectation of receiving future benefits or profits. It is a vital component of long-term financial planning, enabling families to grow their wealth and achieve their financial goals.

- Stocks: Represent ownership in a company and offer the potential for high returns but also carry higher risk.

- Bonds: Represent debt and are generally considered less risky than stocks, providing a steady stream of income.

- Mutual Funds: Pools of money from many investors to purchase a diversified portfolio of stocks, bonds, or other assets, managed by a professional fund manager.

- Real Estate: Investing in properties can provide rental income and potential appreciation but requires careful management and consideration of market conditions.

Saving and Investing are the keys to unlocking long-term financial security for families. By understanding different options and diversification, families can navigate financial markets and build a resilient portfolio to achieve their goals.

Planning for Education Expenses

Planning for education expenses is a critical aspect of family financial planning. With the rising cost of education, it’s essential to start early and develop a strategic approach to ensure your children have access to quality education without burdening the family finances.

Understanding the Costs of Education

Understanding the costs associated with education is the first step toward effective planning. Education expenses encompass a wide range of costs beyond tuition fees, including accommodation, books, transportation, and other associated costs.

Exploring Education Savings Accounts

Education savings accounts are tax-advantaged accounts specifically designed to help families save for educational expenses. These accounts offer benefits, such as tax-free growth and withdrawals when used for qualified educational expenses.

Planning for education expenses is a long-term commitment that requires careful consideration and strategic decision-making. By starting early, families gain more flexibility and can make the necessary adjustments to navigate the financial challenges of funding education.

Protecting Your Family with Insurance

Protecting your family with adequate insurance coverage is an essential component of financial planning. Insurance acts as a safety net, providing financial protection against unexpected events such as illness, accidents, or loss of income. Having the right insurance policies in place helps families mitigate risks and safeguards their financial stability.

Types of Insurance Coverage

Understanding the different types of insurance coverage available empowers families to make informed decisions based on their unique needs and circumstances. Selecting the right insurance policies can provide financial security and peace of mind.

Evaluating Your Insurance Needs

Evaluating your insurance needs involves assessing your family’s unique circumstances, financial obligations, and potential risks. This evaluation ensures that you have adequate coverage to protect your loved ones and financial assets.

- Assess Your Family’s Needs: Consider factors such as the number of dependents, their ages, and their specific needs, such as healthcare or education.

- Review Your Debts and Obligations: Assess outstanding debts such as mortgages, loans, and credit card balances. In the event of a loss, insurance can help cover these obligations.

- Consider Long-Term Goals: Ensure that your insurance coverage aligns with your long-term financial goals, such as retirement planning or children’s education.

Protecting your family with insurance is a proactive step towards safeguarding their financial well-being. By understanding the different types of coverage and evaluating your specific needs, you can make informed decisions to ensure your family is protected against life’s uncertainties.

Retirement Planning for Families

Retirement planning is a vital component of family financial planning as it ensures financial security and a comfortable lifestyle during your retirement years. Starting early, setting clear goals, and making consistent contributions are key steps in building a solid retirement nest egg.

Setting Retirement Goals

Setting retirement goals is a fundamental step in retirement planning. Defining your desired retirement lifestyle, estimating expenses, and determining when you want to retire will help guide your financial decisions.

Retirement Savings Options

Exploring retirement savings options is crucial for building a diversified portfolio and maximizing your retirement savings. Employer-sponsored plans, individual retirement accounts (IRAs), and other investment vehicles are all potential avenues to consider.

Retirement planning is a continuous process that requires adjustments as your life circumstances change. By starting early, setting clear goals, and making informed decisions, families can secure their financial future and enjoy a comfortable retirement.

| Key Point | Brief Description |

|---|---|

| 📊 Budgeting | Track income and expenses to manage finances effectively. |

| 💰 Saving | Build a financial safety net with savings accounts and CDs. |

| 🎓 Education | Plan early for education costs with savings accounts. |

| 🛡️ Insurance | Protect your family with adequate insurance coverage. |

FAQ

▼

The first step is assessing your current financial situation. Understand your income, expenses, and assets to create a foundation for your plan.

▼

Start by tracking your income and expenses. Use budgeting tools and apps to simplify the process and identify areas for savings.

▼

Essential insurance types include health, life, and homeowner’s or renter’s insurance. Evaluate your family’s needs to determine the right coverage.

▼

You should start planning for education expenses as early as possible. Consider opening education savings accounts to maximize tax benefits.

▼

Retirement saving options include employer-sponsored plans like 401(k)s and individual retirement accounts (IRAs). Diversify your investments for long-term growth.

Conclusion

In conclusion, financial planning for families: managing money and building a secure future together is a journey that requires commitment, communication, and informed decision-making. By understanding the basics, budgeting effectively, saving and investing wisely, and protecting your family with insurance, you can create a solid foundation for long-term financial security and achieve your shared aspirations.